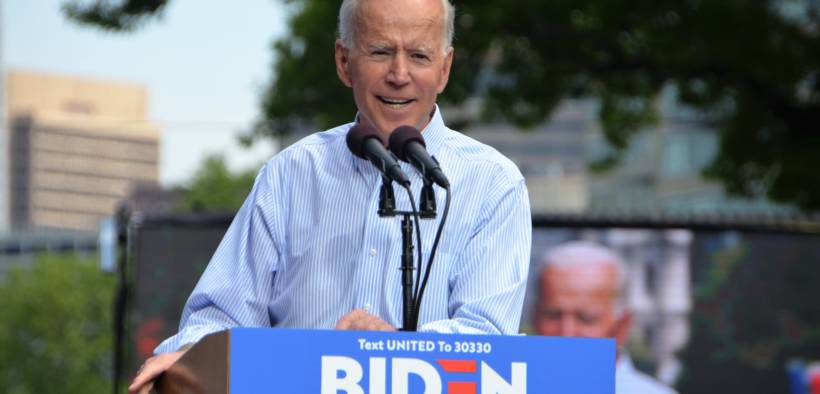

Biden’s Big Money Donors Include Number of Unsavory Corporate Elites

Despite originally promising to forgo super PACs, former Vice President Joe Biden has opened his 2020 campaign to funding from a number of questionable big donors.

Joe Biden’s campaign late Friday released the names of his “bundlers” – wealthy people who tap their networks to raise funds for a campaign – revealing over 200 individuals who have given at least $25,000 in donations to the former vice president’s White House bid. Critics argue that Biden’s dependence on big-dollar donors indicates that he would prioritize their interests if elected president.

Who Are Biden’s Wealthy Donors?

The financial, real estate, and legal industries were some of the prominent fields among Biden’s bundlers, with a private prison profiteer, notable Silicon Valley names and current lawmakers like Pennsylvania Sen. Bob Casey and Delaware Sen. Chris Coons also making an appearance. A numer of former ambassadors, who are often given their positions in exchange for campaign donations, are also on the list:

“They include Elizabeth Frawley Bagley, former U.S. Ambassador to Portugal; Denise Bauer, former U.S. Ambassador to Belgium; Anthony Gardner, former U.S. Ambassador to the European Union; and Mark Gilbert, former U.S. Ambassador to New Zealand, and more,” reported Politico.

Biden’s reliance on big-dollar donors has increased as a consequence of being out-raised by rivals Sen. Bernie Sanders and Elizabeth Warren, who have rejected traditional high-dollar fundraisers in favor of small grassroots donations. South Bend Mayor Pete Buttigieg, who is also courting big-dollar donors, released his list of bundlers earlier this month, although his campaign omitted more than 20 wealthy donors from the list.

Critics like Sludge’s Alex Kotch note that Biden’s financial backers and private fundraising hosts include a number of unsavory characters:

“The president of an investment bank that collapsed from selling junk bonds. A shadow lobbyist at private equity giant Blackstone,” wrote Kotch. “A law partner who defended a Saudi Arabian banker against criminal charges. A lawyer who represents bankers accused of securities fraud. A financial executive who inspired the character Gordon Gekko, a personification of limitless greed.”

Marc Lasry, billionaire hedge fund manager of Avenue Capital Group, and Blair Effron, CEO of investment banking and private equity firm Centerview Partners, are among the top Wall Street Democrats to support Biden. Avenue invests in distressed debt while Centerview has served as an adviser to corporations like Pfizer, Sprint, General Electric, and tobacco company Reynolds, as per Sludge.

Lasry “raised over $100,000 for the 2016 Clinton campaign. From 2006-09, Chelsea Clinton worked as an associate of Avenue Capital. Lasry bundled $500,000 for the 2012 Obama-Biden campaign,” wrote Kotch. Similarly, Effron “gave between $100,001 and $250,000 to the Clinton Foundation. Like Lasry, Effron bundled $500,000 for Obama-Biden in 2012,” Kotch continued, noting that the Democratic donors have also maxed out donations to other candidates.

Biden’s big-dollar donors are also organizing through super PACs, unregulated finance committees that the 2020 hopeful previously pledged to renounce.

The Intercept’s Lee Fang noted that longtime Biden supporter Larry Rasky, founder of lobbying firm Rasky Partners, is one of the super PAC’s organizers. Rasky Partners “is currently registered to lobby on behalf of Raytheon, Harvard Pilgrim Health Care, and the Republic of Azerbaijan.”

Steve Schale, a lobbyist who led the Obama-Biden campaign operation in Florida, is also involved in Biden’s Super PAC effort. Schale boasts a current client list “that includes the Florida Hospital Association, JetBlue Airways, State Farm Insurance, Walt Disney Parks, AT&T, and the Associated Industries of Florida,” writes Fang.

In a 2018 interview with PBS, Joe Biden said he originally advised Bernie Sanders to refuse money from super PACs, because “people can’t possibly trust” politicians who accept money from the unregulated campaign financing vehicles.

“My positions are a hell of a lot closer to Elizabeth Warren and Bernie Sanders on some of the economic positions,” Biden said. “There isn’t – I sat with Bernie. I’m the guy that told him, you shouldn’t accept any money from a super PAC, because people can’t possibly trust you. How will a middle-class guy accept if you accept money?”

Biden’s Ties To The Finance Industry

Biden’s bundlers, private big-dollar fundraising hosts, and super PAC organizers show that the former Vice President remains reliant on a decades-long relationship with the financial industry. Critics argue that this relationship has influenced Biden’s decisions to champion policies that have empowered predatory lenders and fueled debt crises.

Most notable among these is The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) of 2005, which made it much harder for families to pursue Chapter 7 bankruptcy protection, stripped protections on private student loan debt, and it made it easier for creditors to harass debtors for repayment. Biden was one of the bill’s fiercest supporters, also opposing an amendment that would have made it easier to discharge medical debt.

Critics warned that the bill would exacerbate the student loan crisis and put ordinary Americans in financial distress. “This legislation breaks the bond that unites America, it sacrifices Americans to the rampant greed of the credit card industry,” the late Sen. Ted Kennedy said of the bill in 2005. Former Sen. Chris Dodd described it as “one of the worst pieces of legislation of all time.”

Biden’s state of Delaware was home to MBNA, one of the nation’s biggest credit card issuers at the time, later bought by Bank of America. MBNA was a top donor to Biden and a major sponsor of the bill.

“While MBNA, the credit card company based in Delaware, was pushing the legislation, Biden faced charges of being too close to the company,” wrote the Intercept’s Ryan Grim. “‘I’m not the senator from MBNA,’ he protested to the Washington Post in 1999. Three years earlier, his son Hunter Biden had joined MBNA as a senior official. In 2001, Hunter Biden became a federal lobbyist, but stayed on at MBNA as a consultant at a fee of $100,000 per year.”

Hunter’s questionable corporate ties have once again become an issue for Biden. Hunter gained a $50,000-a-month role on the board of Ukrainian energy company Burisma in 2014, despite having no experience in Ukrainian affairs or energy, while his father was “front-and-center” of the Obama administration’s Ukraine policy. President Trump’s alleged efforts to use military aid as leverage to investigate the Bidens’ business in Ukraine is at the center of the ongoing impeachment inquiry.

One of the bankruptcy bill’s loudest critics was former Harvard law professor Elizabeth Warren, who has described her clashes with Congress over bankruptcy law as part of her motivation for entering politics.

“I got in that fight because [families] just didn’t have anyone — and Joe Biden was on the side of the credit card companies,” Warren said at an event in Iowa this spring.

In 2002, Warren published an academic paper in the Harvard Women’s Law Journal that contained a scathing assessment of Biden’s hypocrisy in declaring himself a champion of women and the middle class while passing bankruptcy reform in the service of his donors in the financial services industry:

“Missing, for example, is a picture of Senator Biden standing shoulder to shoulder with the CEOs of the credit industry, cosponsoring legislation to increase restrictions on consumer and small business bankruptcy. His energetic work on behalf of the credit card companies has earned him the affection of the banking industry and protected him from any well-funded challengers for his Senate seat.”

Biden received more than $500,000 from credit card companies, financial services and banks as a senator from 2003-2008.

“I don’t know how else to explain his stance on bankruptcy policy for financially distressed families other than his relationship with the consumer credit industry,” Professor Melissa Jacoby, a law professor at the University of North Carolina at Chapel Hill specializing in bankruptcy, told the Guardian.”There really isn’t another plausible explanation.”

The Recession

Later, while Biden served as Vice President, the Obama administration responded to the subprime mortgage crisis by prioritizing creditors and giving billions in relief to the too-big-too-fail banks, leaving most of the fallout on homeowners and allowing roughly 9 million foreclosures.

Despite Sen. Carl Levin’s referral for the criminal prosecution of top bankers, whistleblower reports from the government and large banks, and FBI and Inspector General of the U.S. Department of Housing and Urban Development reports finding the biggest mortgage firms guilty of mass fraud, the Obama administration refrained from prosecuting bankers or significantly reforming the financial system.

One study found that Biden’s bankruptcy bill “likely prevented a substantial increase in bankruptcy filings” during the recession, limiting relief for millions of Americans suffering from job losses and mortgage and medical debt: “Even given the depth of the crisis, the number of bankruptcies rose to only around 1.5 million in 2010, which is 25 percent lower than the average number of bankruptcies per year prior to the bill’s passage during a relatively healthy economy,” wrote journalist Bob Cesca.

Biden As A Guardian Of The Status Quo

As Citizen Truth’s Carmine Sabia wrote last week, the Biden campaign also has extensive ties to the oil and gas industry. Biden’s campaign co-chairman is one of the fossil fuel industry’s strongest supporters in the House and his climate adviser, Heather Zichal, recently made $1.1 million as a board member at natural gas company Cheniere Energy Partners. Two of the lawyers who successfully defended Exxon against the state of New York earlier this month have maxed out donations to the former vice president.

Biden does not support a nationwide ban on gas fracking and his climate plan was given a “F-” by the Sunrise Movement.

Critics argue that Biden’s record and his reliance on support from Wall Street, the health insurance industry, and fossil fuel stalwarts show that he would maintain the status quo if elected president. Indeed, the former Vice President told a room of wealthy Wall Street donors in June that “nothing would fundamentally change” under a Biden administration.

The late journalist William Greider, who passed away on Christmas Day last week, decried the Democratic party’s abandonment of the working class and warned that it must return to the principles of the New Deal to defeat Donald Trump. Greider argued that under the “New Democrats” represented by Wall Street-funded centrists like Clinton and Biden, the two-party system effectively works as a unit in service of corporate interests:

“The power arrangement resembles a shared monopoly, in which two companies have tacitly ceded territories to each other to avoid costly competition.

“Furthermore, the permanent hierarchy of both parties is dominated at the top by a network of pricey Washington lawyers and lobbyists who represent business interests and collaborate with one another on lobbying the government—while pretending to be opponents. These inside players channel their corporate clients’ money to the elected politicians. In effect, everyone is on the same side.”