Why Federal Stimulus is Always Too Small

The global economic crisis of 2008 should have taught us a lot about how governments cope with major economic shocks, but the level of analysis in 2020 has been abysmal.

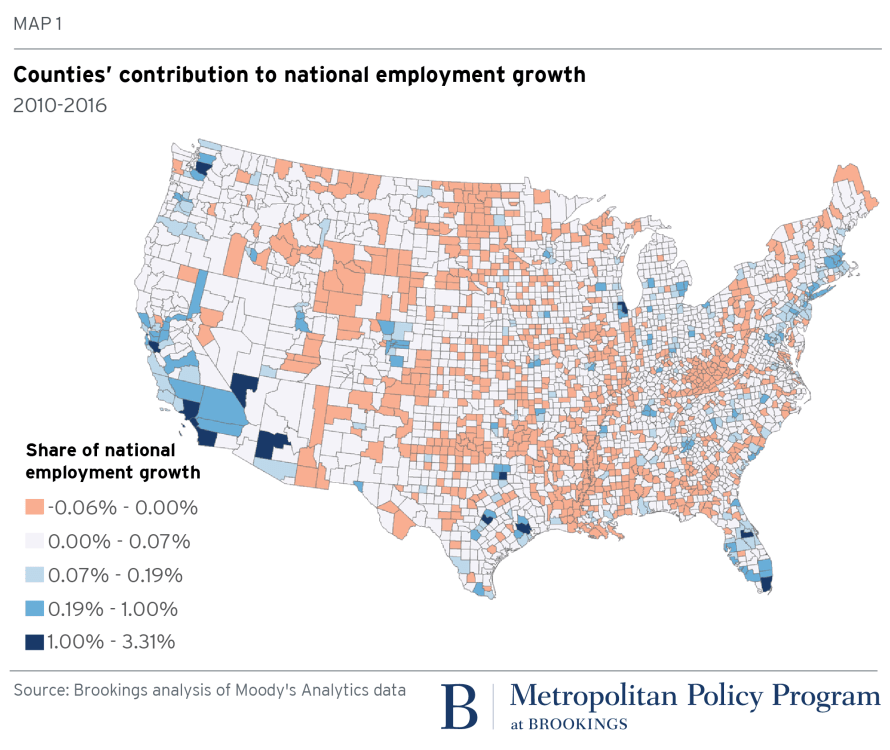

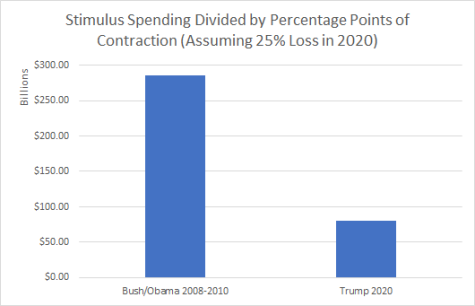

(Benjamin Studebaker) We never seem to learn anything. The global economic crisis of 2008 should have taught us a lot about how governments cope with major economic shocks, but the level of analysis in 2020 has been abysmal. The Great Recession reduced US economic output by 4.2% and destroyed 8.7 million jobs. To counteract the loses, the federal government injected stimulus, first through the Bush administration’s Troubled Asset Relief Program (TARP), and then through the Obama administration’s American Recovery and Reinvestment Act. Combined, these two programs provided about $1.2 trillion. That’s about $285 billion per percentage of point of GDP. It wasn’t enough. The economy recovered very slowly, too slowly for the Obama administration to maintain public support. The Democrats lost the House decisively in 2010. Obama tried to get an additional $447 billion in 2011, but the Republicans had no interest in it. Instead, they pushed for deficit reduction. Obama tried to play nice with them, signing the Budget Control Act in August and making one last push for more stimulus in the Fall. They took his cookies. The second stimulus never happened. As the years went by, rural America continued to lose jobs, and grew more and more resentful, setting the stage for Donald Trump in 2016.

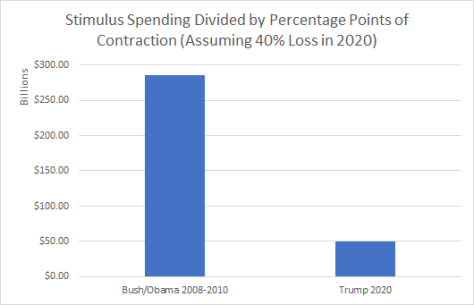

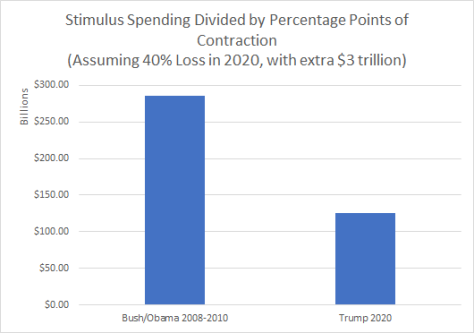

If instead there’s a 40% loss, the Trump stimulus looks pathetic:

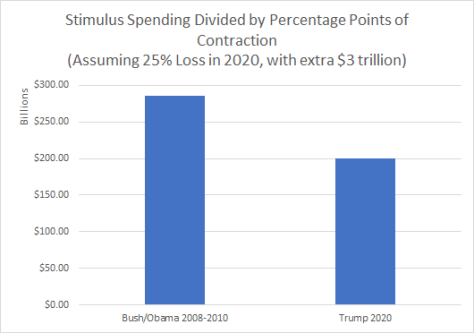

The House has passed a $3 trillion supplementary package, but so far the Senate shows little interest in it. If that $3 trillion package were passed by the Senate and signed into law by the president, it would still leave the 2020 federal response lagging behind. This is true even with the conservative 25% figure:

And of course, it’s even more true with the 40% figure:

The Bush/Obama stimulus wasn’t enough, and the Trump stimulus isn’t close to enough, even if the House succeeds in passing the supplementary package, and that package seems unlikely to pass.

Why do we never pass enough stimulus? The Republicans deny that stimulus works, of course. But that isn’t the whole story. The Democrats always ask for too little up front, and once the Republicans pass one stimulus package they are much less willing to pass a second.

Why are the Democrats so weak and unhelpful during times of crisis? Why aren’t they raring to take advantage of opportunities to fund projects that have long been mothballed?

It’s not because of the deficit. During both 2008 and 2020, the Federal Reserve has demonstrated a willingness to buy US government bonds, pushing US borrowing costs down to negligible levels. At points, US treasury yields have been so low that investors have been effectively paying the US government to sit on their money. The interest rate on them has from time to time slipped below the inflation rate, producing a negative real return.

The real reason is that the Democrats are worried about inflation. If spending were high enough to push the economy back up to capacity, inflation would begin to rise. Inflation disproportionately affects rich people. It reduces the real value of their assets. Poor people don’t have assets. They live from paycheck to paycheck, spending their money as it comes in. In the 1970s, inflation was persistently high for long stretches, and this caused the rich to politically mobilise against the politicians and unions they blamed for the high rates.

Keynesian economists have increasingly argued that our inflation target is too low–that the Federal Reserve ought to pursue an inflation rate of 4% rather than 2%, and that we ought to do stimulus until we are able to move the needle. But this was never something the Obama administration was willing to entertain. Instead, inflation hovered around 2% for the bulk of the recovery. Both parties cared more about keeping inflation at or below 2% than they cared about producing a strong, rapid recovery. Last quarter, US inflation was 0.3%–well below both targets. But the Republicans are still unwilling to spend more, and the Democrats are still being too cautious.

Both parties are in hock to rich people, and consequently the economic policies that Keynesian economists consider to be technocratically correct are politically impossible. The Keynesians have spent the bulk of the last decade writing endless books about policy failure, but the problem is institutional.

An appropriate stimulus would require one of two things to happen:

- We’d have to break the political reliance of one or both of the two parties on the rich, eliminating the obsession with inflation

- We’d need to create additional institutional mechanisms which enable the government to take rapid action if inflation rises too high too fast, increasing our politicians’ confidence in their ability to manage the consequences of large-scale stimulus.

The rich only support institutional mechanisms for managing inflation that shift the cost of that management onto the poor. They would happily support a Value-Added Tax on consumption, because that tax is regressive and disproportionately affects poor citizens who spend most of their money on consumer goods. In 2016, Mike Huckabee called the Value-Added Tax the “Fair Tax”. Currently, the only tool readily available to quickly push back against inflation is the federal funds rate. Raising that rate to push back against inflation rapidly increases the cost of consumer borrowing and produces huge amounts of unemployment. The federal funds rate is controlled by the Federal Reserve, and many of the board’s members have worked for private finance companies or consulted for them. The central bank always begins lifting the interest rate prematurely, keeping inflation down at enormous cost to ordinary Americans.

As long as the oligarchs run the show, we’ll pay the price.

I think our government should give us another stimulus and I’ll tell you why because people has had to borrow money to live on borrow money to get restarted again and..I am afraid people is going to commit suicide.. the American people should receive $2,000 a month until this virus is gone gone gone!.