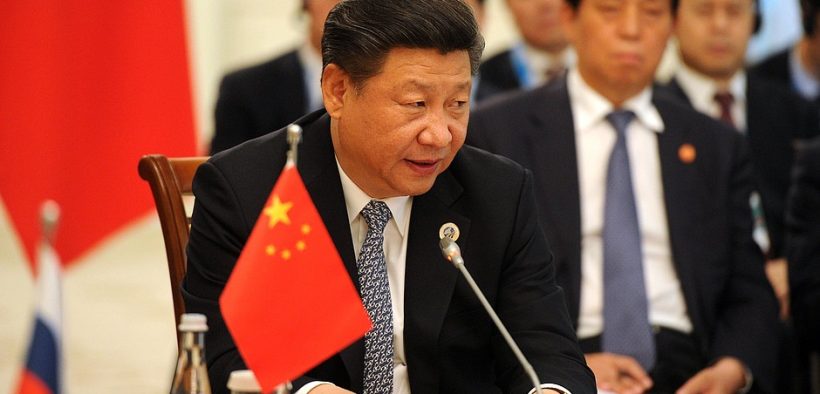

Trump Designates China A Currency Manipulator As Trade War Intensifies

“Economic analysis suggests that bilateral trade wars are unwinnable in an interconnected world. By firing his latest tariff salvo against China, Trump has further raised the stakes in an increasingly damaging dispute. And America is likely to emerge as the bigger loser.”

The latest front in the full-blown US-China trade war has thrown global markets into turmoil this week, as China retaliated to Trump’s most recent tariffs by letting its currency fall, a move that gives Chinese exports a competitive advantage. Trump instructed Treasury Secretary Steve Mnuchin to officially designate China as a currency manipulator in response.

“China has a long history of facilitating an undervalued currency through protracted, large-scale intervention in the foreign exchange market,” Treasury Secretary Steve Mnuchin wrote in explaining the new designation. “In recent days, China has taken concrete steps to devalue its currency, while maintaining substantial foreign exchange reserves despite active use of such tools in the past.”

What Does Currency Manipulation Mean?

As Vox’s Matt Yglesias wrote, most “most modern capitalist economies let their exchange rate “float” according to the vagaries of traders in financial markets.” But the Communist Party of China holds stronger influence over its economy than other major countries, and has used its power in the past to artificially cheapen its currency.

“Beijing has tried to prop up the economy by having the state-controlled banking sector increase lending, making money more available,” explains Keith Bradsher of the New York Times. “That means even more renminbi sloshing around, weakening the currency’s value.”

Devaluing a currency helps boost exports, by making them cheaper to buy for other countries. On the flip side, they make imports more expensive and hurt the purchasing power of the domestic population. Most economists agree that China weakened its currency in the past to help build up its export-oriented manufacturing sector, something Trump views as an unfair advantage.

Critics point to other Chinese economic policies as predatory, such as its tendency to require foreign firms to give up their trade secrets to do business, or its willful neglect of foreign patents and intellectual property laws. But while economists on the left and right have both pushed the US to confront China’s abuses, critics argue Trump’s trade war is driven by impulse rather than long-term strategy, and will ultimately be destructive to the global economy.

Real Problems In China’s Predatory Economic Model

Robert Kuttner of the American Prospect argues China genuinely has perpetrated abuses of the global market system that have enabled the country “to achieve domination in industry after industry, with grave economic and geopolitical consequences for the U.S.”

Kuttner holds respect for Robert Lighthizer, the US trade representative, who he believes has the prudence to use diplomacy and economic leverage for long-term systemic change in China’s economic model.

“China’s mercantilist system, as well as specific abuses such as cyber theft and the pilfering of trade secrets, really does cry out for a muscular U.S. response,” wrote Kuttner in March, hoping Lighthizer’s long-game would overcome Trump’s impulses to define US-China trade policy.

After the most recent tariffs, however, Kuttner believes Trump’s bluster has won out, and posits the president’s relative economic success may be at risk as a result.

“Some U.S. manufacturers are now looking past China in their supply chains. That shift will probably benefit other Asian nations such as Vietnam more than it benefits the U.S,” wrote Kuttner on Wednesday. “China’s willingness to reduce the value of its currency, daring the U.S. to retaliate, is only the latest evidence that Trump’s bravado is backfiring.”

White House May Devalue Dollar In Response

Axios reports that the White House may attempt to devalue the dollar in response to the falling Chinese Renminbi.

A weaker dollar would make US exports cheaper to other countries. It would also help firms and developing countries that hold high amounts of debt in dollars, because the debt would become cheaper to pay off. However, it would hurt the purchasing power of Americans and make imports (likely many consumer goods) more expensive.

Furthermore, it might be hard for President Trump to get major allies in Europe and Canada to cooperate with any multilateral deal on the dollar, since he has repeatedly antagonized them.

Where Is The Trade War Going?

Daniel Gros of Project Syndicate argues that the trade war will be more harmful to the United States than China. One fourth of US imports come from China, while less than one tenth of China’s imports come from the US. Furthermore, the China-specific tariffs will make Chinese goods more expensive for American consumers, while giving other US importers in Europe, Latin America, and Asia room to raise their prices and still be competitive.

US-based firms will also have to bear the cost of disentangling their supply chains from China.

“Economic analysis suggests that bilateral trade wars are unwinnable in an interconnected world,” wrote Gros. “By firing his latest tariff salvo against China, Trump has further raised the stakes in an increasingly damaging dispute. And America is likely to emerge as the bigger loser.”

China, unlike the USA, doesn’t play fair. We get it.